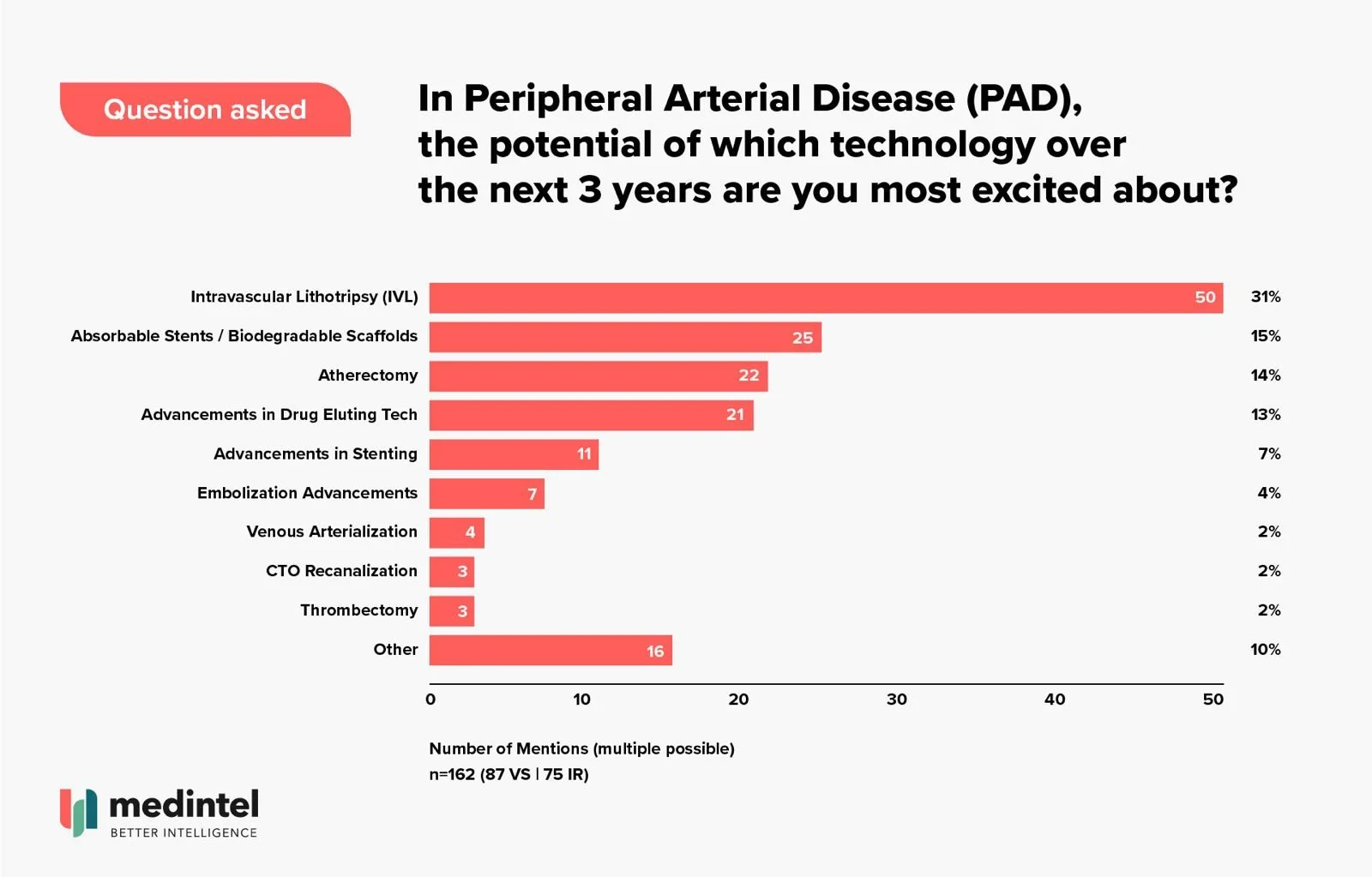

Intravascular Lithotripsy Holds Promise 2:1 Versus Absorbable Stents In PAD

Vascular surgeons and interventional radiologists, showed twice the level of enthusiasm for the innovation offered by Intravascular Lithotripsy than the next technology believed to show most promise, absorbable stents, in offering innovation in Peripheral Arterial Disease PAD treatment over the next three years.

FOR IMMEDIATE RELEASE.

Vascular surgeons and interventional radiologists, show twice the level of enthusiasm for the opportunities offered by Intravascular Lithotripsy (IVL) than the next technology believed to show most promise, absorbable stents, in offering innovation in Peripheral Arterial Disease (PAD) treatment over the next three years.

medintel surveyed 162 physicians (interventional radiologists, vascular surgeons) from across the EU and US, and 31% of physicians named IVL as the technology they're most excited about over the next three years.

This represents more than double the interest in the next category, absorbable stents/biodegradable scaffolds at 15%. Similar differences were seen with only 14% of physicians excited about the possibilities for atherectomy and the same for drug eluting technology at 13%.

Technology physicians are most excited about the potential of in PAD. Surveyed in September 2025.

Intravascular Lithotripsy technology is rapidly transforming the treatment landscape for Peripheral Arterial Disease, with significant growth opportunities forecast. Tibial vessels are highlighted as the highest potential growth area for IVL technology as new, lower-profile devices with longer balloons enter the market.

IVL has revolutionised calcium management in vascular procedures. Physicians report IVL is dramatically reducing the need for stenting in femoral-popliteal treatments while improving safety profiles compared to traditional atherectomy.

‘IVL has transformed calcium management over the last few years,’ notes Kilian Toal, Director at medintel. ‘The ease of use, short learning curve, and applicability across most vessels mean it is rapidly becoming the first choice for many physicians in preparation for severe calcific disease.’

IVL is viewed by physicians as especially beneficial when treating diabetic and end-stage renal disease patients, populations projected to grow significantly in coming years.

While Shockwave Medical currently dominates the IVL market, competitive devices from companies including Bolt Medical (recently acquired by Boston Scientific), Abbott (through CSI acquisition), Amplitude Vascular Systems (AVS) and FastWave Medical are in development or early clinical trials.

Market competition is expected to intensify as reimbursement policies catch up with clinical practice and the growing evidence base continues to demonstrate IVL's effectiveness.

ENDS.

About the Research

Methodology Note: This analysis is based on a survey of 162 (US and EU interventional radiologists, vascular surgeons) conducted in September 2025. This survey represents a focused snapshot of early adopter perspectives rather than a comprehensive market study.

medintel is a specialist medical market research consultancy. For more information, contact intel@medintel.co.uk.

medintel has the capability to conduct larger-scale quantitative and qualitative research across broader physician populations. If you're interested in more extensive RDN market research or custom studies, please get in touch.